We have written on several occasions about the credit bubble that triggered a considerable deleveraging wave in the private sector. However the world has not become a safer place. The debt build up among banks and consumers, in the period before the break out of the Great Credit Crisis 2007-2009, has transferred to the public sector.

Like in physics there is the law of communicating barrels. As one barrel full of water can be emptied with a tube whilst filling another barrel, so is the private sector trying to lower its outstanding debt level while increasing the leverage of the public sector.

Exhibit 1 shows that the total outstanding debt, taking every sector into account (corporates, financials, non-financials, households and governments), is still very worrisome in the developed markets despite a serious deleveraging process in the financial sector.

Exhibit 1 Total Debt as a % of GDP in 2008

Source: McKinsey January 2010

As we have seen during the latest deleveraging cycle, government debts are mounting. This is also described by H. Minsky. The problem is that certain countries before the break out of the crisis already showed bad public finance practices, which makes the current situation even more serious.

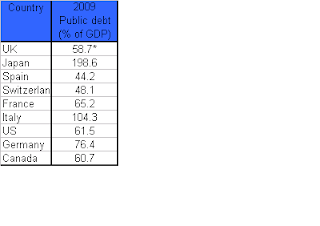

Japan, that has been fighting against deflation for more than a decade, the US and some southern EUR-zone countries are threatened by a sovereign debt crisis. (Exhibit 2)

Exhibit 2 Public debt as a % of GDP in 2009

Source: IMF and * OECD

Bill Gross (Pimco) used a striking analogy for these countries, calling them “the ring of fire” and placed the respective countries in an illustrative matrix. (Exhibit3)

Exhibit 3 The Ring of Fire

Source: PIMCO, January 2010

This is not an unusual phenomenon. Rogoff and Reinhart analysed financial crises and the spill out effects since the inception of banking. In their paper they come to the conclusion that the aftermath of banking crises goes hand in hand with a sharp rise of domestic debt (between 50-100%), which consequently triggers a high inflation environment and ultimately ends in a series of defaults on outstanding sovereign debt and usually a currency crisis.

At this very moment Greece is already becoming a victim of this phenomenon. The spill over effects towards the rest of Southern European countries, the PIGS, is more than science fiction. Therefore all these countries are in the “Circle of Lucifer” as we would call it.

In the CDS market we have already seen a clear divergence since the beginning of last year, and lately the EUR has been under pressure due to the Greek turmoil. However a country that we miss in this Lucifer’s club is Belgium.

We do believe there is a very strong case to be made that the market is underestimating a similar risk for Belgium. At this moment the 5 year CDS spread of Belgium is only trading slightly above 60 bps. Compared with the PIGS countries this is negligible, as all of them are trading well above 100 bp and even higher.

Taking into account the macro economical and political situation of Belgium there is a strong case to be made to buy protection of Belgium sovereign risk. There are a few reasons to underwrite this argument:

• Weak Industry

The Belgian industry has been losing competitiveness over its direct trading partners over the last 8-10 years. The labour cost compared to their main trading partners Germany-Netherlands-France and UK is more than 10% higher which gives them a major competitive handicap.

Furthermore the Belgian industry has disappeared over time in the hands of foreign multinationals. The energy industry for example came into the hands of French conglomerate Suez, and makes Belgium among EU members one of the most energy dependent countries in Europe. As an important side note, Suez is paying 0% taxes on the Belgium synergies due to a tax loop. Due to this, the Belgian Treasury is missing hundreds of million of EUR’s in taxes.

This is an amount that would be very welcome, considering the state of Belgian public finances. Belgian government debt showed a similar trend like other sovereigns around the world, and is expected to rise above 100% of GDP again this year. In this respect Belgian government debt is catching up rapidly with the PIGS debt.

• Wrecked Banking Industry

In Western Europe, the Belgian banking industry was hit almost as hard as Ireland and Iceland. Fortis, Dexia and KBC were brought on the verge of bankruptcy and either had to be sold to foreign competitors (Fortis) or came under curatele from the Belgian government (Dexia) or received very expensive government loans (KBC).

Because of this, the three banks that played a major role for the local mid cap industry that is the driving economic engine of Belgium, remain very restrictive in their credit policy. As a consequence the economy is suffering considerably. In January alone an additional 20,000 jobs went lost, bringing the unemployment rate back above 8.2%, which is an average national level. The differences between North and South are even more flawed. In the South there are regions with over 17% of unemployment.

• Political instability

For over 2.5 years the country has been pulled into its deepest institutional crisis since its inception in 1831. The contradictions between the rich North and the poor South have become so obstructive that it is almost impossible to put a government in place which can run an effective economic policy. The cry for more autonomy is high in the North, Flanders, which destabilizes the country and feeds extremism.

Structural decisions that urgently must be taken in order to tackle the aging of the population and issues around public finances are postponed as there is no will at either side of the language frontier to take an initiative.

• Deteriorating legal environment

Over the last 4-5 years Belgian dropped on the official UN Corruption ladder a couple of notches and is now at the same level of Italy. The Justice Department is hopelessly underinvested and understaffed. It is no exception that law suits settle after more than 10 years. There are even several examples where certain legal disputes even expire their legal dead line which creates a legal vacuum for business.

Jail sentences of less than 3 years are not executed anymore because of a painful over population of prisons, for which Belgium has been condemned already on several occasions by the Court of Human Rights, which feeds a further feeling of anarchy.

Taking all these arguments into account, there is a good reason to expect that Belgians credit spread will start sliding off into the direction of the PIGS and soon becomes a member of the Circle of Lucifer.

No comments:

Post a Comment