This is the debt I pay

Just for one riotous day,

Years of regret and grief,

Sorrow without relief.

Pay it I will to the end --

Until the grave, my friend,

Gives me a true release --

Gives me the clasp of peace.

Slight was the thing I bought,

Small was the debt I thought,

Poor was the loan at best --

Oh God! What about the interest!

P.L. Dunbar

No, we are not struck by lightening and convert our Givanomics bi-weekly newsletter into a Death Poet Society club. We just continue our journey along the mounting debts governments are stacking up across the world and building further on the topic Bill Gross raised at the beginning of this month with his “Rings of Fire”.

In the past we have pointed at the series of causes of the Great Credit Crisis 2007-2009. There were several seeds planted over the course of time, and by the summer of 2007 they created a lethal jungle.

One of these was globalisation with its emerging economies that via currency manipulation were flooding the financial markets with USD liquidity, which even puzzled Alan Greenspan at the time with its “interest rate conundrum” and “savings glut”. The reason behind that originated from previous crises. Emerging market economies learned their lessons from the Asian and Latin American Crises which had devastating effects on their respective economies. As a consequence, instead of reinvesting the monies into their own economies, they repatriated the USD’s back to the US who went on to use it as ATM money to fund their housing market (bubble).

There was also a demographic phenomenon influencing financial markets. To a certain extent we can argue that the baby boomer generation had a huge share in the equity bull market of the late 1990s and the internet bubble.

A study of Barclays and the IMF confirms this trend.(1) During the late 1990s the share of baby boomers that started to re-direct their savings into equities reached an all time peak. This inflated the stock market rapidly and one can even argue that the internet hype was irrelevant to the bubble build up. Even without the presence of the IT revolution a bubble would have formed taking into account the demographic forces in play.

As far as the US is concerned, one should take into account two major data points. First of all the share of the group of 35-55 year olds grew to 30% of the total population by the beginning of the new millennium. This group had the highest saving ratios, while putting that money at work into the stock market. Simultaneously, a second group of retirees was slowing down rapidly as well during the same period. (The newly retired)

As two tectonic plates collide, these two groups created a severe shift in capital market flows. The 35-55 group that was accumulating stocks grew rapidly while the retiree group that was selling stock diminished rapidly. A similar phenomenon we had seen in Japan during the 1980s which caused a gigantic stock and real estate bubble.

In summary a cocktail of demographic shifts and globalisation, which contributed to a low inflation environment, contributed to the equity bubble which forced the Federal Reserve to intervene with monetary stimuli which in turn contributed to last decade’s housing bubble.

So far a brief summary of the last 20 years. This brings us back to the future where these two tectonic plates are still in full motion and are going to influence the aftermath of the Great Credit Crisis 2007-2009 substantially.

On the one hand we have the group of 35-55 year olds (the baby boomers) that is going to shrink more rapidly due to the ageing of society. This will have a negative impact on saving ratios which in turn will have a negative effect on asset valuation. On a side note we would like to warn that this phenomenon will not be limited to the Western world. Countries such as China will be confronted with a similar situation 5-8 years from now as well. (see our Givanomics on China and its demographics in December 2008)

Then there are the emerging markets that keep on growing and raise their share in global GDP continuously, aided by currency manipulation. The latter is less relevant at this point in the discussion, although over the long term this is going to create huge tensions on the FX market, which we see as taking the spotlight in future asset allocation.

For now we want to focus on the impact that demographics will have on markets and more specifically the consequences it will have on public finances. The debate is back on the agenda as government deficits are back on the rise, going ballistic since the Great Credit Crisis and a reason of major concern.

In Belgium for example, both the central bank and an ex-minister (an authority in the field of pension issues) issued a severe warning. The analyses they made are nothing new. The remedies to sail the ship through a heavy storm are less convincing.

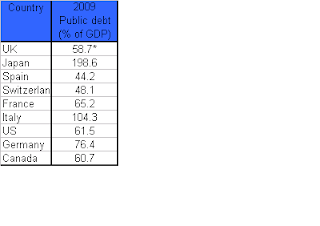

First we sum up some numbers again, based upon a recent study of the IMF on the effects of ageing societies and also confirmed by the OECD and the Barclays study.

(2) The data is quite upsetting taking into account the current situation.

In the next 20 years the most developed countries among the G20 will see their government debts rise by at least 50%. From 2030 onwards this will even accelerate and government debt ratios of 275% of GDP will be seen by 2050 in the West.

Exhibit 1 G20 economies forecasted government debt evolution

Source: IMF, March 2009

The chart above is only showing an average picture for the G20 on aggregate. Obviously some countries will be hit harder than others. Data from the IMF indicates that Japan and South Korea have a demographic time bomb ticking under their public finances. For example Japan year to date has already a government debt of almost 200 % of GDP. By 2030 an expected additional 190% of GDP may be added to this mountain of debt.

In case of the US this is 40% of GDP that can be added to its current government debt level by 2030.

The major problem at this moment is that due to the Great Credit Crisis, certain governments’ savings for this demographic earthquake have been used to save the economy from falling into a depression. As a consequence all the reserves that have been put aside are not there anymore and create extra pressures. In the first place we think of the core EUR-zone countries that applied fiscal discipline over the last 10 years to fulfil the Maastricht Treaty.

Then there are other countries where the situation is even worse, such as the UK and the US who did not show fiscal discipline over the last decade and have no reserves at all. In these countries one could argue that they have stronger privatised pension schedules compared to continental Europe.

There are two reasons to suggest this is no panacea either. First of all the US and UK household saving rates are inferior to the levels of mainland Europe. Over the last 1.5 decades in both countries it dropped to 2% and 4% respectively, as households got buried deeper and deeper into (mortgage) debts. Therefore the savings rate had to go up substantially in these countries eventually, but it is a paradox in an ageing society environment. Supported by empirical evidence we know that an ageing society tends to save less.

The pension reserves that have been built up also have been affected heavily due to the stock market correction which wiped out gains of an entire decade. Estimated losses in the U.S. and the U.K.during 2008 are, respectively, 22 percent and 31 percent of GDP. (IMF data)

Not that UK pensions suffer a unique disease. Across the pension industry, overambitious payout schemes were promised to the retirees. A standard practise is to commit to 6% compounding returns until the retiring age. These returns were probably plausible in the 1980s and 1990s, however the low yield environment over the last decade has changed the investment climate drastically.

The law of compounding interests can go very quickly against a fund manager who has to make 6% year after year. In this case an annual loss of 30% makes it almost impossible to meet its promises in 20-30 years time, unless much higher risks are taken.

The US is not only facing such a problem in its private pension schemes. The mismatches between its long dated pension liabilities and its reserves are jeopardizing its wrecked public finances further.

The local states, such as New Jersey and California to name only a few, have promised considerable pension and retirement benefits to their employees without putting aside enough money to pay for them. According to a report by the Pew Centre (a US think tank )on the States’ condition, the 50 states on aggregate have accumulated more than $3.3 trillion in long-term liabilities (between now and 2030) in pensions, health care and other retirement benefits that are promised to their current workforce and retirees, but they only have made $ 1 trillion of reserves against this.

Since US states are legally obliged to have a balanced budget at the end of each fiscal year, there are only two outcomes. Either they eventually default under these liabilities with retirees being left in the cold, or the government has to bail them out, adding a multi-trillion hole in the US deficit.

The outcome of all this can be twofold.

Under a first scenario, where governments do not have the courage to take painful but structural measures, the outcome will be one of higher inflation and maybe in some cases hyperinflation. As the private sector will see its saving rate decrease (the OECD anticipates a drop between 3.5-6% of GDP on savings) and the public sector will run deficit after deficit, it will become increasingly difficult to meet domestic commitments.

In this environment risk premiums on government bonds will skyrocket. Back in 2005, a long time before the Great Credit Crisis broke out and public finances were not affected by the crisis yet, Standard & Poor’s simulated the rating evolution of the UK, US, France and Germany. Back then all countries were expected to lose their AAA rating rapidly between 2015-2025 all the way down to BBB- by 2035 at the latest. In the meantime, conditions only deteriorated. (3)

Therefore it is not an understatement to say that risk premiums on government fixed income paper are expected to rise significantly over time.

As far as growth prospects is concerned this would also be a scenario which would perfectly fit into the New Normal described by Pimco’s CIO, Mohamed El-Erian, where a prolonged period of below average growth is waiting for us.

Reinhart and Rogoff, who are very topical with their “This time its different” book, have also recently published a paper where they investigate the impact of government debt on economic growth. They come to a similar conclusion as Mohamed El-Erian, but based on an empirical analysis of the relationship between economic growth and government’s total debt (taking into account also private debt).

They come to the conclusion that real GDP, adjusted after inflation, falls by one percent from the moment your debt GDP ratio rises above 90% of GDP. When external debt (taking into account private and corporate debt) rises above 60% of GDP this will deduct another 2% of GDP growth, and in case of higher levels growth is even cut in half. (4)

In a second scenario, where governments would have the ambition to take painful measures, the outlook will not be more prosperous, but at least there will be a relief from the gigantic debt burden that is weighing on each of our shoulders.

In a scenario like this the government is going to cut drastically on the supply side. There is an economic law that argues that whatever the public sector spends needs to be saved by the private sector and vice versa. In this case the government will bear that responsibility. The governmental labour force would have to be reduced significantly in order to bring down a heavy public payroll and public pension liabilities.

Those civil servants that are allowed to keep their jobs will be faced with pay cuts.

Furthermore the massive pension liabilities and promises the governments have made will also have to be brought down one way or another. This can take place in a very refined manner by increasing the legal retiring age above 70 years, or by simply reducing the promised pay outs. Certainly in continental Europe private pension schemes will have to be promoted much more than in the past.

This scenario will have an opposite effect and trigger further deflationary pressures as the private sector will increase its saving rates further, this time at the expense of consumption. As a consequence, growth will be below average as well, which fits once again into the New Normal.

The question remains though whether governments are prepared to take these type of decisions as this will cause substantial social unrest.

Either way, more and more we are convinced that the Great Credit Crisis from 2007-2009 was also the beginning of the end of an era…

(1) Barclays Capital: “Equity Gilt Study 2010”, Jan 2010

(2) IMF, “The State of Public Finances: Outlook and Medium Term Policies After the

2008 Crisis” March 2009

(3) Standard & Poor’s, “In The Long Run, We Are All Debt: Aging Societies And

Sovereign Ratings”, June 2005

(4) C. Reinhart and K. Rogoff “Growth in a time of debt”, Harvard University,

December 2009